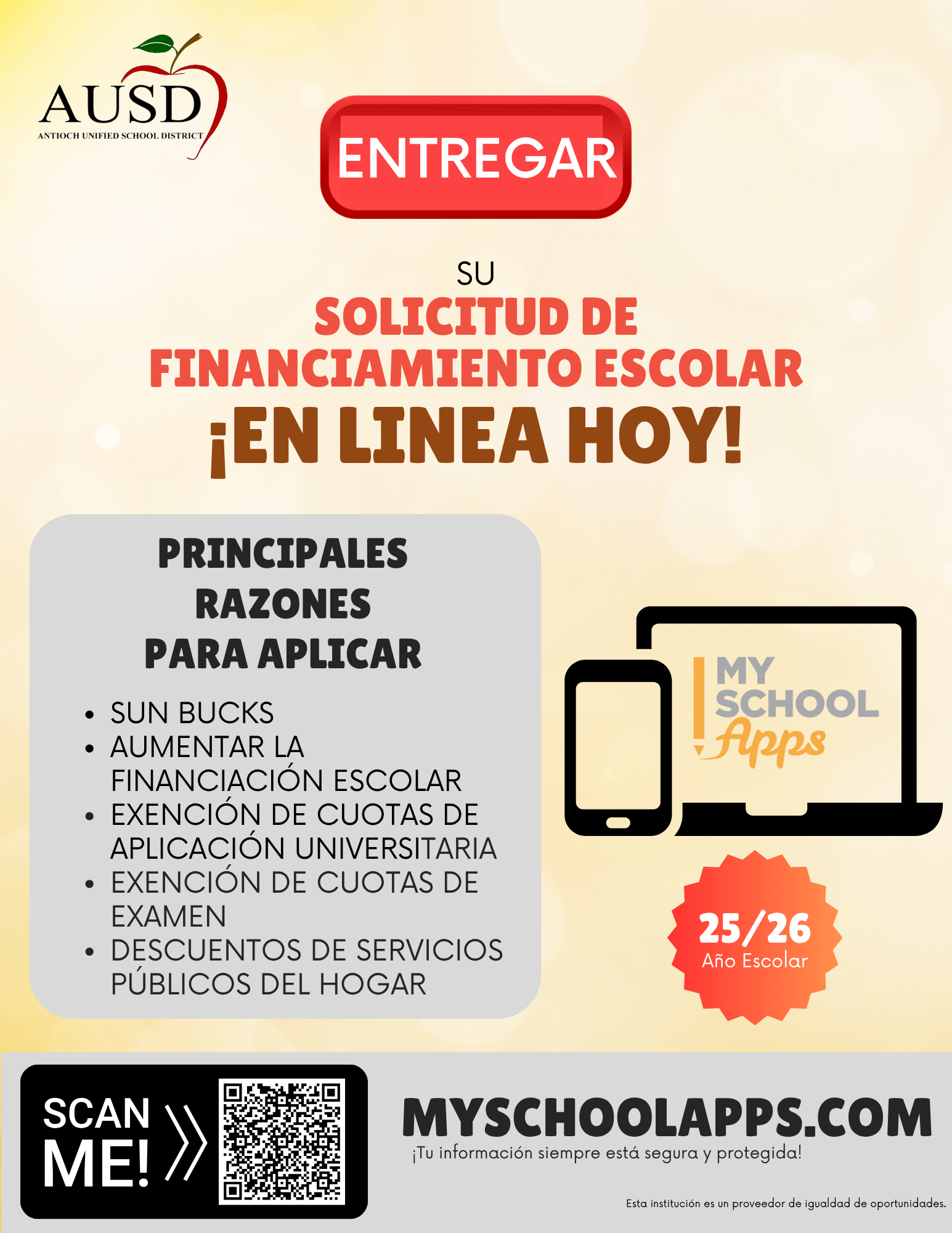

SUN Bucks / School Funding Form

What is the School Funding Form?

The School Funding Form collects basic information about your student, including household size and income.

Your family may also receive Community Benefits available to free or reduced-price qualifying households, such as:

SUN Bucks / Summer-EBT

Discounts on utilities

Reduced-cost or free internet service

Lower fees for SAT, ACT, AP tests, and college applications

Completing this form helps ensure your school receives all available funding and benefits to support teachers and students.

Information

If you have received an email from Antioch USD that your student is Directly Certified or qualifies for Community Benefits available to free and reduced-price households for the 2025-2026 school year, you do not have to complete a new application.

Do I need to complete the form for my child to receive free school meals?

No. All students, regardless of household size or income, are eligible to receive free breakfast and lunch every school day.

Application Results Letter

If you submitted an online application through www.myschoolapps.com and need a copy of your results letter, please complete the Eligibility Letter Request Form here: https://forms.office.com/r/u0QKi340sV

You may also contact the Nutrition Services Office at 925-779-7600, option 2.

CalFresh Food

CalFresh Food helps people from low-income families buy the nutritious food they need for good health. Recipients can buy food at any grocery store or farmers market that accepts Electronic Benefit Transfer.

SELECT: GetCalFresh.org, an on-line CalFresh application tool that takes 10 minutes to complete. It is available in English, Spanish and Cantonese.

CALL: Call the CalFresh Info Line 1-877-847-3663 to get connected to your county. The Info Line is available in English, Spanish, Cantonese, Vietnamese, Korean, and Russian. For speech or hearing assistance call 711 Relay.

COME IN: Use the interactive locator map to find a county office nearest you.

If you have any questions regarding CalFresh Food, please contact by phone 1-877-847-3663 or on the website at CalFreshFood.org.

Earned Income Tax Credit

Based on your annual earnings, you may be eligible to receive the Earned Income Tax Credit from the Federal Government (Federal EITC). The Federal EITC is a refundable federal income tax credit for low-income working individuals and families. The Federal EITC has no effect on certain welfare benefits. In most cases, Federal EITC payments will not be used to determine eligibility for Medicaid, Supplemental Security Income, food stamps, low-income housing, or most Temporary Assistance For Needy Families payments. Even if you do not owe federal taxes, you must file a federal tax return to receive the Federal EITC. Be sure to fill out the Federal EITC form in the Federal Income Tax Return Booklet. For information regarding your eligibility to receive the Federal EITC, including information on how to obtain the Internal Revenue Service (IRS) Notice 797 or any other necessary forms and instructions, contact the IRS by calling 1-800-829-3676 or through its website at irs.gov.

You may also be eligible to receive the California Earned Income Tax Credit (California EITC) starting with the calendar year 2015 tax year. The California EITC is a refundable state income tax credit for low-income working individuals and families. The California EITC is treated in the same manner as the Federal EITC and generally will not be used to determine eligibility for welfare benefits under California law. To claim the California EITC, even if you do not owe California taxes, you must file a California income tax return and complete and attach the California EITC Form (FTB 3514). For information on the availability of the credit eligibility requirements and how to obtain the necessary California forms and get help filing, contact the Franchise Tax Board at 1-800-852-5711 or through its website at ftb.ca.gov.